HEC Paris tax expert Professor Mirko Hayat optimistic about future of transparency in offshore banking

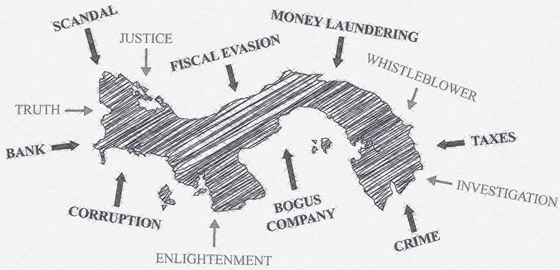

After the Panama Papers revelations, Mirko Hayat, affiliate professor in law and tax at HEC Paris, considers that this massive leak of offshore financial records will fast track an existing trend toward tax transparency in countries known as tax havens. This could, in turn, lead to more tax entering national coffers, and ultimately lower tax rates, he says.

"More transparency in these countries is inevitable", says Professor Hayat, who adds that this trend gained momentum in the last decade, especially after the financial crisis in 2008, well before the advent of recent leaks. "Panama Papers, Luxleaks and Swissleaks have simply served to speed up the process," he adds.

Next year Luxembourg is set to reach a level of full transparency, whereby if a non-national sets up an account on its soil, this information will automatically be communicated to the country concerned. Switzerland has pledged to follow suit in 2018. “Both countries once ruthlessly guarded their banking secrecy”, says Hayat, "yet today they are showing their commitment to transparency. Banking secrecy in both these countries is therefore coming to an end."

(...)