“Private Equity regains popularity among investors” - Professor Oliver Gottschalg on the latest HEC-DowJones Ranking

This year’s HEC Paris Dow-Jones Private Equity Rankings have just been released, revealing the private equity firms that have, over a whole decade of fund activity, generated the highest returns for investors. Oliver Gottschalg, Associate Professor of Strategy and holder of the HEC Private Equity Observatory, discusses the results.

The Private Equity industry is notorious for being opaque and access to any data is chronically difficult. In particular, little is known about the performance and competitive behavior of the key PE firms. While there were performance rankings in many other areas (for instance, the best ‘business school’, the best ‘place to work’, the best ‘stock market analyst’ etc.), there was nothing of the kind that existed within PE. Until recently, the only available rankings for Private Equity were based on size alone, which provided us with very little practical use. Thus, HEC Paris and DowJones joined forces in 2009 to publish regular rankings of PE Firms based on their historic performance as well as expected future competitiveness respectively.

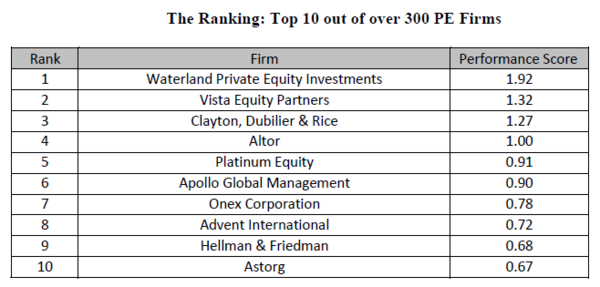

In this video, Professor Gottschalg looks at the different players listed in the 2016 Top 10 rankings and analyzes the reasons behind their success. While there is clearly no one recipe for success, Prof. Gottschalg highlights the fact that Private Equity has been regaining popularity among investors and it is likely that this trend will continue in the next couple of years.

****

The 2016 HEC-DowJones Private Equity Performance Ranking lists the world’s top PE firms in terms of aggregate performance based on all buyout funds raised between 2003 and 2012. This ranking tells us which firm(s) generated the best performance for their investors over the past years. The ranking draws on a comprehensive set of data on PE fund performance provided by Dow Jones and directly from PE firms. The ranking’s methodology aggregates performance across vintage years and considers relative and absolute returns. In total, PERACS has analyzed performance data from 446 PE firms and the 791 funds raised between 2003 and 2012 with an aggregate equity volume of $1,115bn.

Read more about:

2016 Press Release Ranking

Access to the report

Knowledge@HEC article: Buyouts: when ownership by private equity firms matters