Antin Specialists Reveal Telecom Tower Success to HEC Paris Students and Academics

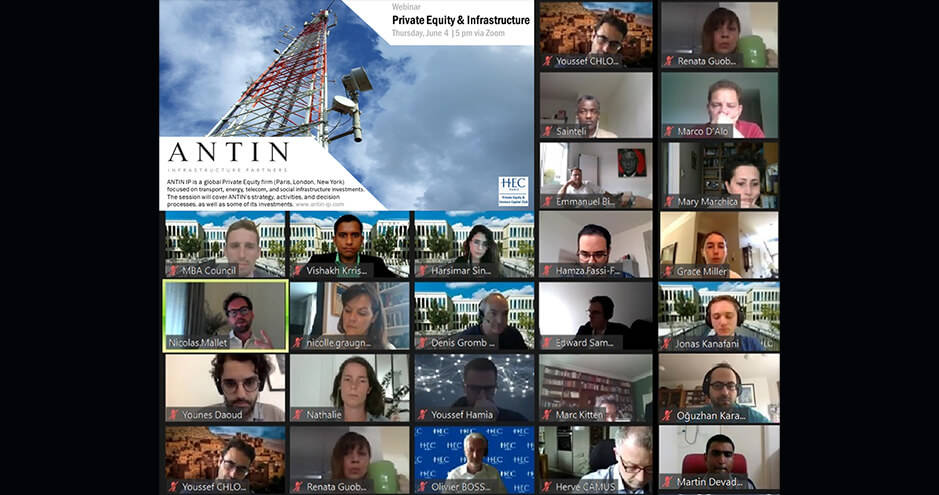

On June 6, the HEC MBA Private Equity Club organized a webinar exchange between, on the one hand, two professionals from Antin Infrastructure Partners, a private equity firm investing in infrastructure assets and, on the other, over 170 participants and alumni from different HEC Paris programs. The discussion centered on Antin’s activity and, by way of illustration, on a 2012 investment in telecom towers in France.

The two-hour June webinar was the latest in a series of collaborations between Antin and HEC Paris as part of a joint Chair program initiated in 2018. The ties go even deeper, as the CEO and co-Managing Partner of Antin Infrastructure Partners, Alain Rauscher, actually graduated from HEC in 1984.

This time, the exchange focused on one question: how do you transform over 2,000 telecommunication towers into a profitable infrastructure business in just four years? As those attending a two-hour virtual webinar found out, Antin has a few key solutions. The private equity company is known for its creativity in selecting brownfield infrastructure assets and in implementing a value-add strategy before selling after a few years. But, as HEC’s Professor Denis Gromb, and coordinator of the Chair, explains, telecom towers like those Antin purchased from Bouygues Telecom in 2012 were not even recognized as infrastructure at the time because “investors thought about telecom as being exposed to technological risk, competition, demand shifts, etc.”

Perhaps so, but as Antin’s Nicolas Mallet explained in the webinar, Antin proved the business had all the infrastructure attributes: resilient, stable, essential, inflation-protected, to name but a few. Mallet was part of the small team which led the transaction eight years ago and guided the project right through to its sale in 2016. Alongside his colleague Hamza Fassi-Fehri (H08), he described to the webinar attendees how Antin transformed the business by adding other telecom companies as tenants on the towers; purchasing the land plots; securing space on highway towers, electricity pylons, rooftops and water towers; and other original initiatives which boosted the towers’ value. They then sold them as bona fide infrastructure asset.

Antin Upbeat on Job Recruitment during Crisis

“Antin has always tried to find assets in new subsectors it viewed as having infrastructure characteristics in a dynamic way.” So much so that the company decided to expand its geographical reach to the other side of the Atlantic. A year ago, Hamza Fassi-Fehri moved to Antin’s newly opened New York office. As an investment director, he has capitalized on the rich eco-system and networks he has built up over the years at the firm to make inroads at record speed. Answering a question from IT expert Vishakh Krishnan, Fassi-Fehri underlined the essential nature of the New York outreach: “We are European by nature, but we are seeking new markets and reaching out to the United States was a major but natural development. The expansion offers our investors new opportunities without us competing head on with US companies.”

Naturally, the attendees brought up the global pandemic and its impact on Antin’s portfolio. “It’s a tough issue to answer,” admitted Mallet, who broke down the company’s view into three phases. “We have been very resilient in phase 1, the confinement, the sectors linked to social interaction and telecom activity did well. But, with a potential economic crisis looming in the deconfinement phase 2, it is very difficult to know what consequences this will have on Antin’s activities.” He also pointed out that the pandemic might have longer-term impact, favorable or adverse, on different infrastructure assets and that Antin, with its long-term focus, was actively thinking about those. Mallet was quick to reassure aspiring candidates for job openings: “Despite the crisis, we are continuing to recruit. Incidentally,” he concluded, “Antin has changed a lot over the years: banking experience was often a pre-requisite but nowadays we are large enough to integrate training as part of the job. So please do send in your candidacy for work.”