Does CSR protect a firm against reputation losses?

Executive Factsheet

Firm reputation, i.e. the way a firm is perceived by its stakeholders, is an asset of central importance to a company. CSR can serve as an insurance against reputational risks, meaning that the firm will suffer a less severe loss of its market value after a negative event if it engages in CSR activities. Research indicates that there are three essential preconditions for this mechanism to work: (1) the firm engages in CSR on the long term; (2) the corporation’s behavior is consistent, i.e., the firm does not only attempt to “do good” but also tries to “avoid harm”; (3) the negative event is not followed by a subsequent one.

Download the PDF: Does CSR protect a firm against reputation losses?

Can CSR serve as an insurance against reputation risks?

Yes it can. Research has shown that a firm’s CSR activities can serve as a buffer against reputation risks, i.e. reduce the reputational damages from which the company would suffer after an adverse event, such as a product recall. (1) (2)

Why is that?

If stakeholders ascribe moral value to a corporation before a negative event, they will tend to judge the reasons for such an event in a more positive way, by attributing it to “bad luck” rather than “bad management”. (1)

How should corporations engage in CSR in order to ensure this insurance effect? (1)

First, a company needs to engage in CSR on a long-term basis. In fact, short-term CSR engagements do not significantly protect from reputation losses linked to adverse events. (2)

Simply engaging in some sort of long-term CSR activities is not enough to build an image as a morally valuable firm reducing reputational risks.

In fact, firms have two levers at their disposal in order to build such a reputation: (1)

- One is “doing good”, i.e., engaging in activities that are commonly perceived as being positive, such as investing in local community services or treating employees particularly well.

- The other one is “avoiding harm”, i.e. keeping away from practices that are generally badly perceived, such as employing slave labor or abusing of one’s superior bargaining position over vulnerable suppliers or workers.

It is only by doing both that a firm can effectively diminish the negative effects of events affecting its image as compared to otherwise similar companies.

How large is this insurance effect?

The insurance effect of CSR has been evaluated for S&P 500 firms in the context of product recalls. (1)

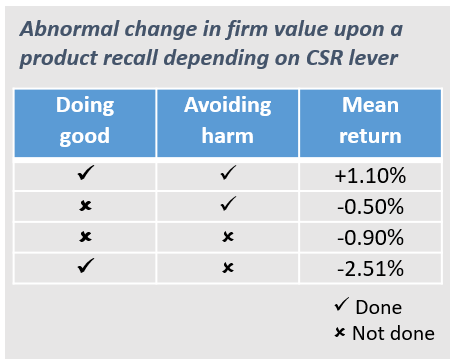

As shown in the table below, a company saves an average of 1.10% of its firm value after a product recall, if it does good while at the same time avoiding to do harm. For an S&P 500 company with an average market capitalization of USD 20 billion, this amounts to roughly USD 200 million in improved firm value.

Inconsistency, however, is severely punished: a company additionally loses an average of 2.51% (about USD 500 million in lost firm value for an average S&P 500 firm) if it does good while at the same time not avoiding harm.

Source: Reference (1)

Does the insurance effect of CSR last forever?

No it does not. In fact, CSR’s insurance effect quickly disappears after a subsequent occurrence of negative effects.(2)

For management, this means that claims of adherence to CSR can be used only once in crisis communication.

REFERENCES

1- Minor, D., & Morgan, J. (2011). CSR as reputation insurance: Primum non nocere. California Management Review, 53(3), 40-59.

2- Shiu, Y. M., & Yang, S. L. (2017). Does engagement in corporate social responsibility provide strategic insurance‐like effects?. Strategic Management Journal, 38(2), 455-470.