US firms lead with 15 positions in the top 20 2023 Mid-Market Buyout Performance Ranking

US firms lead with 15 positions in the top 20 2023 Mid-Market Buyout Performance RankingHEC Paris Business School and Dow Jones today announce the release of the 2023 Mid-Market Buyout Performance Ranking. The ranking highlights the potential of specialised sector strategies within the Mid-Market space. It answers the question: “Which firms generated the best performance for their investors over the past years?”.

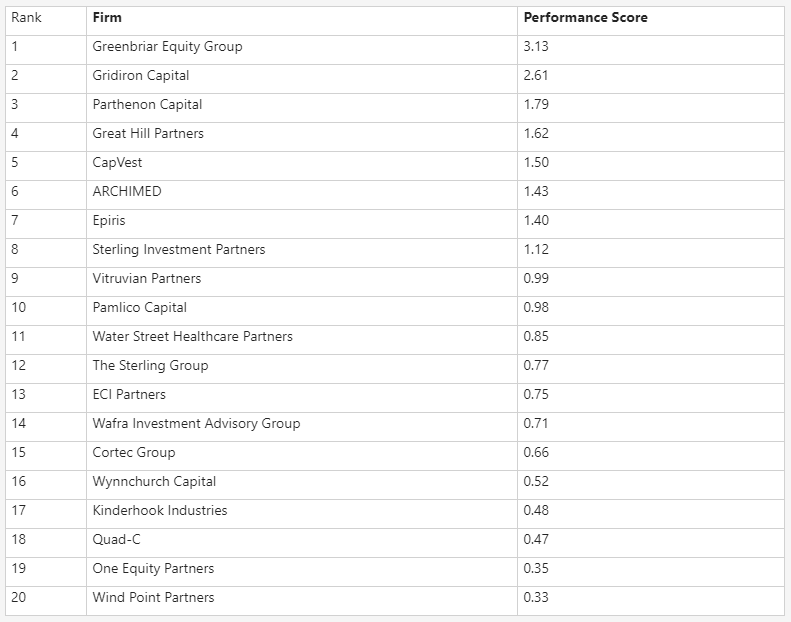

Transport sector focussed Greenbriar Equity Group takes first place, followed by Gridiron Capital and Parthenon Capital. “This is despite the transport industry not typically being a prime destination for PE investments or the source of outstanding buyout returns”, according to the author of the ranking, HEC Paris strategy Professor Oliver Gottschalg and holder of the school’s Antin IP Chair on Private Equity and Infrastructure.

The Top 20 also includes healthcare-focussed GPs such as French-based Archimed and US-based Water Street Healthcare Partners, which have secured positions 6 and 11 respectively.

The “Top Decile” Worldwide Ranking: Top 20 out of over 632 PE Firms

The ranking evaluated performance data from 632 PE firms and the 1241 funds they raised between 2010 and 2019 with an aggregate equity volume of $2.18tr.

The selection criteria required PE firms to have raised between $1bn and $5bn through at least two funds from 2010 to 2019, with investments in the US, EU, or globally. This resulted in 95 firms meeting these criteria. This draws on performance information from all relevant buyout funds managed by a given PE Firm and aggregates their performance based on a novel and proprietary methodology into one overall performance score.