hec paris master in management's student team on the road to the 2016 harvard international finance competition finals

On April 23rd, a team of international students will represent HEC Paris in the final round of this prestigious case competition

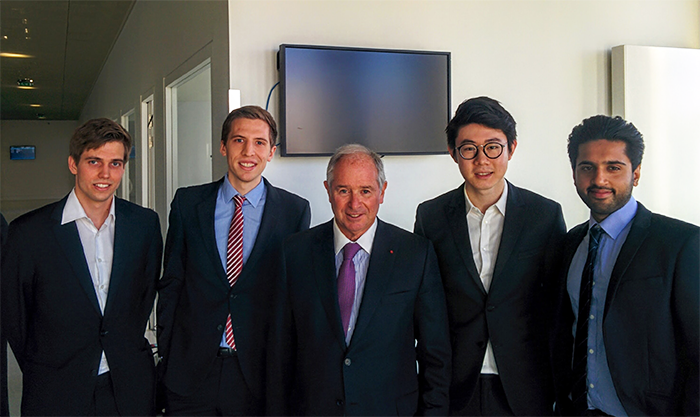

(from left to right): Piotr DZIADOSZ, Dominik Stefano CAMPANELLA, Stephen A. Schwarzman (Blackstone CEO), Zhongqiang LIN, Vaibhav LONGANI

The Harvard International Finance Competition is an annual flagship event organized by Harvard Extension Business Society aimed at bringing together Finance and Business students from prestigious international universities. Participants compete in a finance case at Harvard which focuses on firm valuation and investment banking.

The finance case used for this year’s competition was written by Joel Heilprin, Professor at Harvard Business School. A preliminary round of CV screenings was conducted by the organizing committee, and the selected teams were then eligible to participate in the second round of the competition. After the second round’s case submission, an intensive reviewing and selection process was conducted by Harvard, and the top 10 teams from the first round are given the opportunity to make a short case presentation at the final event, to compete for the prize. Finalists’ presentations will be given to a select panel of esteemed professors and distinguished industry professionals.

This year, a team called Modigliani – consisting of four Master in Management students, will have the honor of representing HEC Paris in the final round of this case competition at Harvard on April 23rd. The team is culturally and ethnically diverse, comprising four international students of four different nationalities. The name Modigliani is inspired from the Modigliani-Miller-Theorem learnt from a Corporate Finance class at HEC Paris. The class is taught by HEC professor Clemens Otto, whose inspiring teaching style has helped the team in building a solid foundation and understanding in valuation analysis.

The Blackstone Case

The case assigned to the team was related to one of the largest leveraged buyout transactions in the history of the private equity industry. In 2007, Blackstone, the American multinational private equity group, paid $26 billion in total to acquire full ownership of Hilton Hotels. As part of the investment process of Private Equity transactions, a thorough analysis and due diligence is performed prior to the execution of a deal. Each participating team in this competition was tasked with creating an investment memo illustrating the key areas to address in a typical LBO process and provide further insights regarding the Blackstone acquisition of Hilton. An in-depth level of industry and company research, detailed financial analyses, thorough valuation and investment analyses were required to be completed in this investment memo.

The HEC team, Modigliani, consisting of Dominik Stefano Campanella, Lin Zhongqiang, Vaibhav Longani, Piotr Dziadosz, reflects on the intense preparation for the case submission

“Given the degree of complexity of this leveraged buyout transaction and the amount of research that needed to be conducted, our team was under a great deal of time pressure. Yet, the team was determined to submit a work of the highest possible quality and consequently win the competition as the final goal.”

Team Modigliani continues “To start with the case presentation, the team had an intense meeting and came up with a clear timeline and a step-by-step progress track schedule that each member committed to fully to deliver their workload. At a second meeting, the team set up the structured approach to the case and went through an intensive brainstorming session on each section of the case. Later, during the case development stage, each team member worked on different sections including both macro analysis on the industry and sector and detailed analysis on the company, but all individual efforts were subject to very rigorous and constructive peer review. Lastly, the team also provided sensitivity and scenario tests and supplied further relevant investment risk analysis and mitigation.”

To conclude, Team Modigliani says “We think that besides the blood and sweat that we dedicated to this case, it is the teamwork spirit and the HEC spirit – "the more you know, the more you dare" which led us through our conquest to this great learning journey.”

Due to the ethical standard of the assignment, the Team was forbidden to seek advice from other students, school professors or industry professionals; Team Modigliani claims that courses that were taught this semester, including Strategy and Corporate Finance, have equipped the team with the necessary knowledge and insights to analyze the case information and finally crack the case.

Read more about the program

Master in Management