Does CSR protect shareholder value?

Executive Factsheet

Even though investments in corporate social responsibility (CSR) can be costly, they offer a form of insurance and social capital protecting companies from negative corporate events and market shocks.

Download the PDF: Does CSR protect shareholder value?

The relationship between corporate social performance and corporate financial performance (1)

The way corporate social responsibility (CSR) contributes to corporate financial performance (CFP) is not straightforward. Recent replication studies merely report a mixed relationship; while prior CFP is positively associated with subsequent corporate social performance (CSP), prior CSP is unrelated to subsequent CFP. In other words, better financial performance improves CSP. However, CSR investments may not lead to higher CFP, i.e., “doing good” does not necessarily mean “doing well”.

The role of context and stakeholder responses (1)

Even though these results suggest rather bleak prospects for CSR proponents, they also point out important implications. To understand how CSR relates to CFP, we need to observe the effects of the prior CSP to the subsequent CSP and take stakeholders’ responses into account. Two perspectives provide further insights.

The risk management perspective (2)

Some scholars argue that CSR engagement is a sign of a company’s intention to consider social and environmental issues in business decisions and thus leads to favorable attributions from different stakeholders. CSR creates an atmosphere of goodwill that offers protection against negative events, e.g., public disputes and corporate scandals. Just like an insurance premium or buffer, CSR may help to avoid, reduce, or loose market value after a negative event. Thus, instead of generating CFP, CSR may preserve it.

The insurance-like effect of CSR (2)

Event studies confirm this notion:

- In the aftermath of a negative event, higher the long-term CSR engagement is, (comparing to short-term CSR) smaller the loss of the shareholder value.

- In particular, after a negative event, financial firms with long-term CSR activities had less (cumulative) abnormal returns on stocks and bonds than firms with short-term CSR activities.

- Yet, the insurance-like effects of CSR disappeared after a second occurrence or repeated negative events.

This indicates that, in particular, when companies face a corporate crisis, long-term CSR engagement is capable of preserving both bond- and stockholder wealth. While short-term investments in CSR offer only little protection, seemingly, continuously “doing good” pays off for companies that experience turmoil. Yet, firms are advised to avoid repetitive involvements in negative events since the insurance-like effects of CSR appear to wear off over time.

The social capital and trust perspective (3)

Similarly, researchers suggest that CSR builds social capital and trust between a company and its various stakeholder sets. In particular, in times when overall trust in companies is low, shareholders may place a valuation premium on companies with high levels of CSR, and stakeholders may more likely support firms that have shown greater stakeholder cooperation in the past.

CSR during the financial crisis (3)

Studies examining the performance of firms during the 2008-2009 financial crisis support this perspective. They find that:

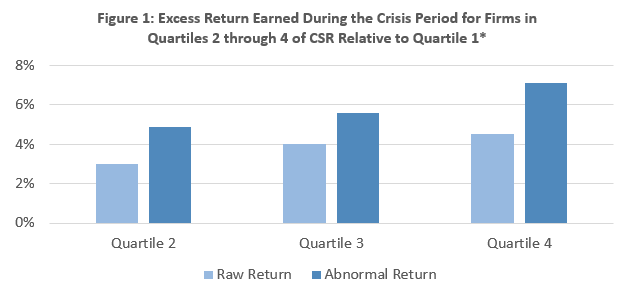

- Companies with high social capital (built up through CSR activities) had 4-7% higher stock returns than companies with low social capital (Figure 1).

- Moreover, firms with high CSR ratings raised more debt and experienced higher profitability (sales growth, and employee productivity) than firms with low levels of CSR.

These results suggest that investments in CSR build firm-level social capital and trust between companies and their investors as well as other stakeholder groups. Companies benefit from social capital, especially, during a period when the relevance of trust increases abruptly. In other words, when markets suffer from a negative shock, companies that display high CSR perform better than those with low CSR ratings.

*Source: Lins, K. V., Servaes, H., & Tamayo, A. (2019). Social capital, trust, and corporate performance: how CSR helped companies during the financial crisis (and why it can keep helping them). Journal of Applied Corporate Finance, 31(2), 59-71.

REFERENCES

- Zhao, X., & Murrell, A. J. (2016). Revisiting the corporate social performance‐financial performance link: A replication of Waddock and Graves. Strategic Management Journal, 37(11), 2378-2388.

- Shiu, Y. M., & Yang, S. L. (2017). Does engagement in corporate social responsibility provide strategic insurance‐like effects? Strategic Management Journal, 38(2), 455-470.

- Lins, K. V., Servaes, H., & Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. The Journal of Finance, 72(4), 1785-1824.