The corporate cash boom: What every CEO needs to know

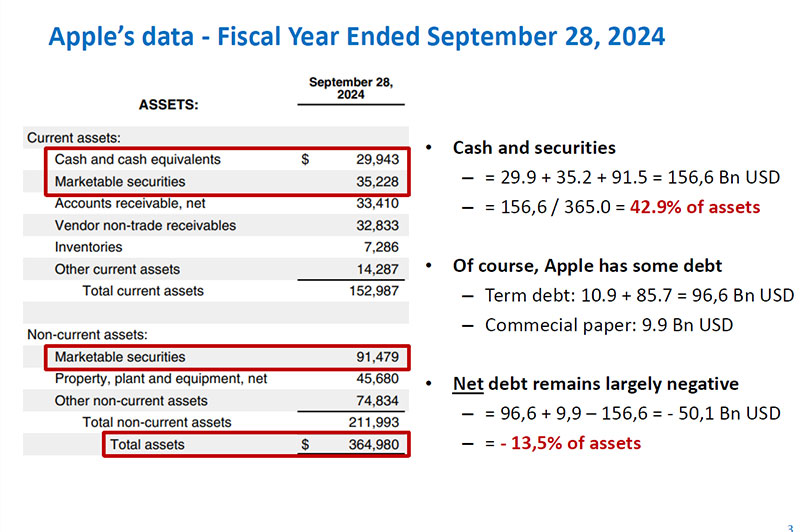

Did you know that corporate cash reserves worldwide now exceed $8 trillion, a figure that dwarfs the GDP of most nations? Apple, for instance holds 43% of its total assets in cash and marketable securities- more than its total debt. But is this financial strength or a symptom of strategic inertia? Across industries, corporations have transitioned from traditional borrowers – raising funds for expansion – to net lenders, injecting excess capital into global financial markets. This represents one of the most significant financial shifts of the 21st century.

But why is this happening? Is it a sign of corporate prudence, or does it pose risks to financial stability? What does this mean for banks, investors, and economic growth? And most importantly, how should CEOs and CFOs navigate this evolving financial landscape?

Guillaume Vuillemey, Associate Professor in Finance at HEC Paris, explored this evolving trend in a recent Masterclass. From tax incentives and the rise of intangible assets to the impact on financial markets and banking stability, the discussion shed light on a phenomenon reshaping the way businesses operate and manage liquidity.

Understanding the corporate cash boom

Once reliant on borrowed capital to fuel growth, businesses are now sitting on record levels of cash, fundamentally altering their role in financial markets. But what is driving this shift, and what are the broader implications for businesses and the economy?

How big is the corporate cash pile?

Imagine buying shares in a company, only to realize that nearly half of its balance sheet consists not of cutting-edge technology, groundbreaking products, or innovative infrastructure, but cold, hard cash. This is the reality for Apple, where 43% of total assets are held in cash and marketable securities, far outpacing its total debt.

Apple is not an outlier. Across industries, corporations are amassing cash at unprecedented levels, fundamentally shifting their role in global finance. Once seen as natural borrowers – raising funds to invest in tangible assets and drive economic expansion – companies have now become lenders, holding significant financial reserves and placing them in a range of securities. This transformation is not just a curiosity of corporate accounting; it marks a fundamental change in the way businesses operate.

How do corporations save?

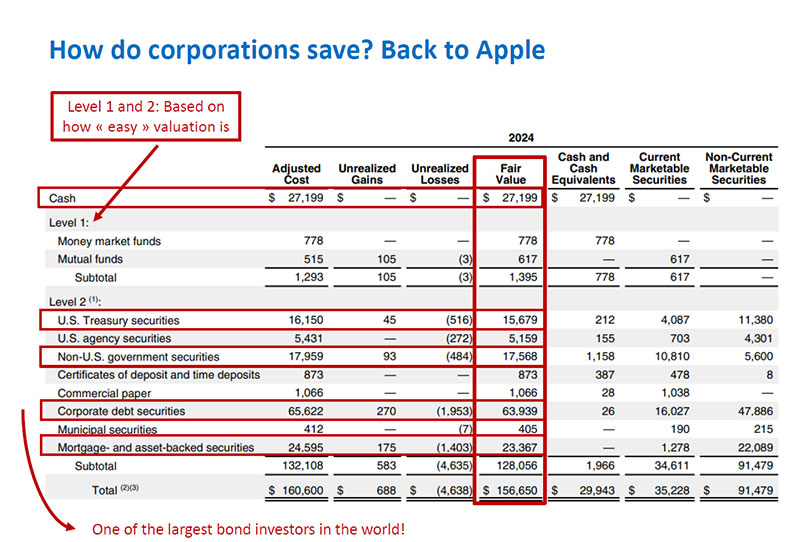

When we think of corporate cash reserves, we often picture stacks of banknotes sitting idly in a vault. In reality, corporate savings have evolved far beyond cash. Today, companies are not just stockpiling money – they are actively investing it.

Take Apple, for example. While it holds nearly $30 billion in cash, the bulk of its reserves – over $125 billion – is tied up in marketable securities. These aren’t just short-term liquidity buffers; they include U.S. Treasury bonds, corporate debt securities, and mortgage-backed securities, making Apple one of the largest bond investors in the world.

And Apple is far from alone. Across industries, corporations have become key players in global financial markets, effectively acting as institutional investors. Instead of borrowing from banks and issuing debt, they are now lending capital to governments, other corporations, and even households. This shift is reshaping financial ecosystems, influencing interest rates, and altering the flow of capital worldwide.

Why are companies accumulating so much cash?

Companies stockpile cash for many reasons, but two major forces stand out.

Reason #1: Tax incentives and profit shifting

One of the key reasons companies accumulate vast cash reserves lies in cross-border tax optimization. By shifting earnings to low-tax jurisdictions, global firms have long minimized their tax liabilities, keeping profits offshore rather than repatriating them to their home countries.

A prime example of this dynamic played out in 2017, when the U.S. Tax Cuts and Jobs Act (TCJA) was introduced.

This sweeping reform marked a turning point by transitioning the U.S. corporate tax system from a worldwide model – where companies paid taxes on foreign earnings when repatriated – to a territorial one, taxing only domestic income. As a result, many firms, including Apple and other Silicon Valley giants, seized the opportunity to bring billions back home at a lower tax rate.

While tax considerations have undoubtedly contributed to the corporate savings boom, they do not fully explain the trend. If taxes were the primary driver, we would expect cash reserves to shrink following favorable tax reforms. Instead, corporate balance sheets continue to swell, suggesting deeper structural forces are at play. So, if tax avoidance isn’t the full story, what is?

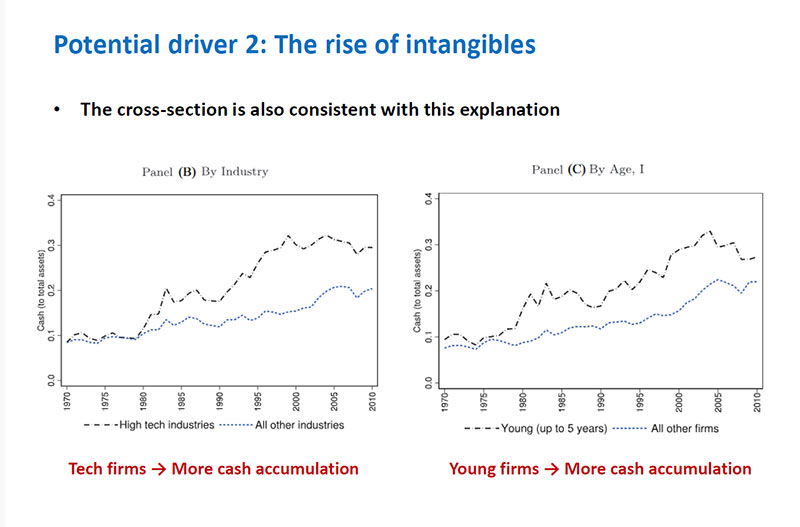

Reason #2: The rise of intangible assets

The nature of corporate investment has changed dramatically. In the past, companies poured their capital into factories, machinery, and other physical infrastructure – tangible assets that could be used as collateral for loans. Today, the most valuable assets in many industries are intangible: patents, software, brand equity, and intellectual property.

While these assets drive innovation and growth, they present a fundamental challenge in corporate finance: they cannot be easily financed with debt. Unlike a factory or a fleet of vehicles, a company’s brand reputation or proprietary algorithm cannot be seized by a bank in case of default. This makes traditional borrowing riskier and less viable for firms heavily reliant on intangibles.

The solution? Cash. Companies accumulate liquidity as a safeguard, ensuring they have the financial flexibility to weather economic downturns, invest in research and development, and fund acquisitions – all without depending on external lenders.

This shift explains why some of the world’s largest tech firms, from Apple to Alphabet, maintain massive cash reserves. More than avoiding debt, it’s about securing independence in an economy increasingly driven by intangible value.

Consequences: A new source of financial instability?

How corporate cash impacts banks

For decades, bank deposits were considered one of the most stable sources of funding in the financial system. Individuals deposited their savings, rarely moved them, and most accounts remained insured, fostering confidence in the banking sector.

But today, corporate deposits are reshaping the equation. With companies holding record amounts of cash, businesses – not individuals – are now some of the largest depositors in banks. Unlike retail deposits, however, these corporate funds are often uninsured and highly mobile, meaning they can be withdrawn in large sums at a moment’s notice.

This shift introduces a new layer of risk for banks. Traditionally, deposit insurance provided by institutions like the FDIC (Federal Deposit Insurance Corporation) in the U.S. ensured that smaller depositors remained confident in their banks, minimizing the likelihood of bank runs. But corporate treasurers, managing hundreds of millions in liquid assets, are not bound by the same inertia. If market conditions change, or if confidence in a bank wavers, they can swiftly withdraw vast sums, creating liquidity crises overnight.

This growing reliance on corporate cash means banks must now manage a far more volatile funding base. And as the world witnessed in March 2023, this volatility can have devastating consequences.

Case study: The collapse of Silicon Valley Bank (SVB)

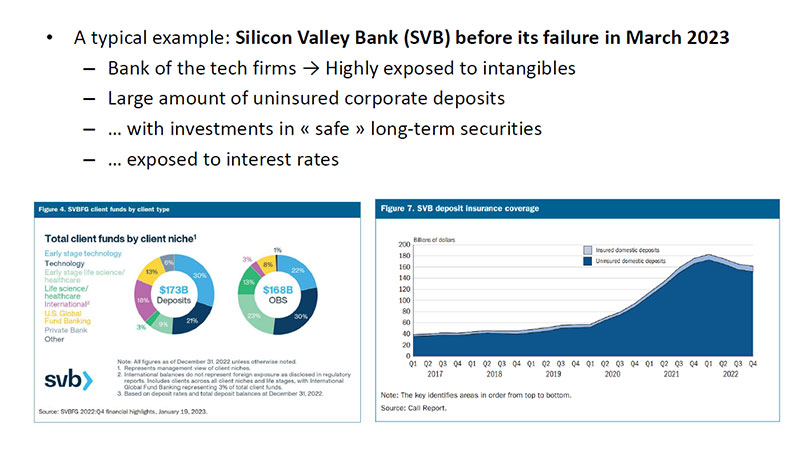

In March 2023, Silicon Valley Bank (SVB) collapsed almost overnight, marking one of the most significant banking failures in U.S. history. At the heart of its downfall? The very same corporate cash boom that has reshaped financial markets.

SVB was the preferred banking partner of tech startups and venture-backed firms – businesses that, in recent years, had amassed enormous cash reserves. Unlike retail customers, these corporate clients deposited huge sums, often well beyond the FDIC’s $250,000 insurance limit. In fact, more than 90% of SVB’s deposits were uninsured.

At the same time, SVB invested heavily in long-term securities, including government bonds and mortgage-backed securities. These were considered "safe" investments – until interest rates started rising. As the Federal Reserve hiked rates aggressively, the value of SVB’s bond holdings plummeted, creating massive unrealized losses on its balance sheet.

Then came the panic. Corporate depositors, aware of the bank’s vulnerabilities, moved fast. Within a single day, billions were withdrawn as tech firms rushed to secure their cash elsewhere. Unable to cover the sudden outflows, SVB collapsed in what became the second-largest bank failure in U.S. history.

The lesson is clear: The corporate savings glut is actively reshaping financial risk. With businesses now holding and moving unprecedented amounts of cash, banks must rethink their risk models. The SVB debacle was a wake-up call, highlighting the fragility of a system increasingly dependent on uninsured, highly mobile corporate deposits.

Strategic implications and key questions for corporate leaders

Do companies hold too much cash?

Corporate cash reserves are often seen as a sign of financial strength, providing firms with flexibility and resilience. But not everyone is convinced that holding massive amounts of cash is a good thing. Some investors argue that companies are hoarding cash at the expense of shareholder value.

A prime example of this debate is Carl Icahn’s public battle with Apple. The activist investor repeatedly pressured Apple’s leadership to return more cash to shareholders, arguing that the company’s enormous reserves were wasteful and inefficient. In an open letter, he criticized Apple’s reluctance to deploy its cash, calling for increased share buybacks and dividends.

The risks of excessive cash :

1. Tax inefficiencies: Corporate cash is often parked in low-yield investments that generate taxable interest income. Meanwhile, companies that take on debt benefit from tax shields, as interest payments are deductible. This imbalance raises the question: Are firms missing out on financial optimization by holding too much cash?

2. Governance concerns: Large cash reserves reduce financial discipline. Companies flush with cash may be more prone to overpaying for acquisitions, engaging in empire-building rather than making value-driven investment decisions. Research suggests that firms with excess cash often make poor M&A choices, acquiring businesses that dilute shareholder value rather than enhance it.

While cash is a vital buffer in uncertain times, too much can be a liability. Investors want to see a balance: enough liquidity to weather downturns but not so much that it signals a lack of strategic direction or inefficient capital allocation. As firms continue to pile up cash, the debate will only intensify: Are they safeguarding their future, or simply avoiding the hard decisions?

Are bank deposits the right saving instrument for companies?

The collapse of Silicon Valley Bank (SVB) in March 2023 exposed a major vulnerability in corporate cash management: should businesses really be storing billions in bank deposits?

Traditionally, deposits were considered a safe and stable way to hold cash. However, the SVB crisis revealed their hidden risks. As panic spread, companies rushed to withdraw their funds, triggering a liquidity crisis that the FDIC (Federal Deposit Insurance Corporation) had to step in to contain. The problem? Most corporate deposits far exceed the FDIC’s $250,000 insurance limit, making them highly vulnerable in times of financial distress.

Given these risks, should corporations rethink how they save? Rather than holding excess cash in uninsured deposits, businesses might be better off diversifying into money market funds or other short-term financial instruments. These vehicles offer liquidity while reducing the concentration of risk within a single financial institution.

The SVB fallout also raises an important regulatory question: Should governments continue to step in and backstop corporate cash when banks fail? By guaranteeing uninsured deposits, regulators effectively bailed out cash-rich firms, prompting concerns about moral hazard and unfair risk redistribution.

As corporate cash holdings continue to grow, financial leaders and policymakers face a critical decision: Should companies rely on bank deposits as their primary savings tool, or is it time to rethink corporate cash management entirely?

The need for financial leadership in a changing landscape

For CEOs and CFOs, this shift presents a strategic challenge: How much cash is too much? Where should it be held? And how can liquidity strategies align with long-term growth and shareholder expectations? Traditional approaches to corporate finance are being disrupted, demanding a new level of financial expertise.

In this evolving landscape, leaders who understand these complexities will gain a competitive edge. Financial decision-making is no longer just about managing balance sheets: it’s about navigating risk, optimizing capital allocation, and preparing for the unexpected.

For senior executives and finance professionals seeking to develop the strategic expertise required to thrive in this environment, HEC Paris’s Executive MSc in Finance (EMiF) is a world-class program designed to transform financial leadership.

This 18-month executive master’s program is structured around three key pillars:

1. Financial Valuation: Master advanced corporate valuation techniques, capital budgeting, and risk assessment.

2. Asset Management & Markets: Gain cutting-edge insights into investment strategies, macroeconomic risks, and investor relations.

3. Strategic Finance & Transactions: Learn to navigate high-stakes corporate events like M&A, IPOs, and leveraged buyouts.

Delivered by renowned HEC Paris faculty, including leading researchers and senior professionals in investment banking and corporate finance, the program blends rigorous academic frameworks with real-world applications. Participants also gain access to the HEC Paris Alumni network, opening doors to a powerful community of finance leaders worldwide.

If you are ready to elevate your expertise and shape the future of corporate finance, discover how HEC Paris can help you achieve your goals.

Download the brochure or apply now to join the next intake.