How to Succeed in Finance Without Losing Your Soul

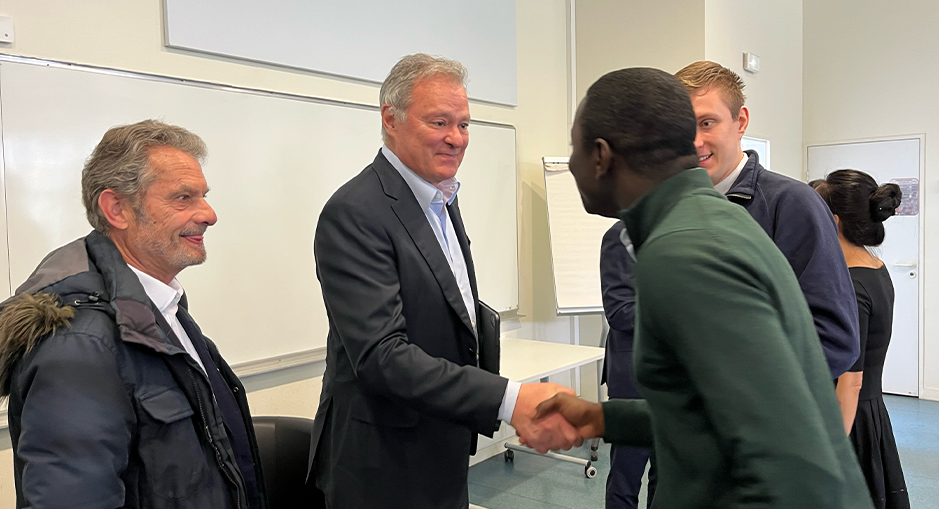

At the close of the 2025 Private Equity & Infrastructure Certificate at HEC Paris, Alain Rauscher, co-Founder, Chairman and CEO of Antin Infrastructure Partners, offered students more than a masterclass on becoming an entrepreneur in the financial industry. He shared a humanistic vision of finance—one grounded in purpose, values, and the power of relationships.

1. Expand Your Views: The Value of a Non-Linear Path

Alain Rauscher’s route to finance was anything but traditional. A graduate in philosophy and literature, he candidly recalled feeling like a “zombie” in his first marketing class. “I moved from Hegel to potato chip packaging,” he joked. But instead of walking away, he chose to stay the course—and he’s grateful he did.

What he discovered at HEC was an openness that still shapes his thinking today. “We were encouraged to study broadly,” he said. “You’re part of a pool of talent, but it’s important to think outside the box and get as rich an education as you can.” For Rauscher, HEC’s blend of academic rigor and intellectual flexibility offered a space to explore—not just finance, but the humanities, history, and the arts.

His advice to students was clear: don’t trap yourself in a box—neither a job nor a discipline. Life is a journey. “You are not a finished product,” he said. Start with curiosity, and don’t be afraid to explore across domains—academic, extracurricular, and professional.

That curiosity eventually led him to Bain & Company, where he gained a foundational understanding of business and problem-solving. Consulting was, for Rauscher, “the broadest teaching” he could find at the time—a way to delay premature specialization while learning how businesses worked from the inside.

2. Encounter Talented People: Relationships That Shape a Career

Throughout his journey, encounters with remarkable individuals played a pivotal role. Rauscher emphasized the importance of meeting people who challenge and elevate you—what he called “quality encounters.” Among them was Pierre Vernimmen, the legendary HEC professor and author of the benchmark corporate finance textbook Le Vernimmen, whose combination of humanity and high standards left a lasting impression. “He empowered you,” Rauscher recalled. “He’d say, ‘You don’t need me for that—but if you do, I’ll be there.’”

Equally transformative was his encounter at BNP Paribas withAlain Papiasse (HEC EMBA).

It was Papiasse who encouraged him to think differently—to consider building something of his own. “You don’t just want a new job,” Papiasse told him. “You want to do something meaningful with your life.”

That nudge proved transformative. It helped Rauscher see entrepreneurship not as a risky detour, but as a natural extension of his experience, values, and aspirations. “If someone you admire believes in you,” he told students, “you start to believe in yourself.”

These encounters didn’t just offer opportunities—they provided trust, confidence, and new perspectives. They can prove decisive in helping you make the right choices. For Rauscher, they were a powerful reminder that soft skills and human connections matter just as much as technical expertise in finance.

3. Make Career Choices Based on Values

At a time when many choose finance for compensation or prestige, Rauscher urged students to align their decisions with their values. “What do you want out of life?” is the guiding question he encouraged students to ask themselves—not only as they prepare to launch their careers, but again and again throughout life.

For him, becoming an entrepreneur in finance was a natural extension of his family history—both his father and grandfather were entrepreneurs—and of his own desire to build something independent and long-term.

But it also required courage. Quitting a prestigious role at BNP Paribas to start Antin, mortgaging his house to fund the venture, and navigating internal tensions to buy out the bank’s stake—these were not decisions made lightly. They were driven by conviction.

4. Choose a Corporate Culture That Fits You

Rauscher’s professional path includes high-powered institutions across the finance world. But not all experiences were equal, and he didn’t hesitate to walk away when the culture clashed with his values. At one firm, he encountered what he described as a “political and controversial” environment, filled with internal rivalries and power struggles. In contrast, at BNP Paribas under Pierre Vernimmen’s leadership, he found a culture of trust and empowerment. “He was demanding, but he trusted you to do your best,” Rauscher said. “That made all the difference.”

He warned students: culture is not soft—it’s strategic. When companies prioritize short-term performance over trust, the cost can be immense. He recalled Lehman Brothers firing a third of its staff after the 1987 market crash—an act he saw as a fundamental breach of trust. Massive layoffs, even in times of crisis, can do irreversible harm, he believes. “You destroy trust,” he explained. “People start asking, ‘Am I next?’ And when that happens, the culture begins to unravel.”

These experiences deeply influenced the values he built into Antin Infrastructure Partners, with his co-founder Mark Crosbie. From the start, they sought to create a company where respect, collaboration, and long-term thinking would shape the decision-making culture. Trust wasn’t just a moral preference—it was a strategic pillar.

“You cannot make good decisions alone,” Rauscher said. “They emerge from confronting viewpoints.”

5. Make Bold Choices with a Long-Term View

One of the most compelling parts of Rauscher’s message was the importance of conviction. Spotting long-term trends—such as the shift to infrastructure investing or the rise of AI—requires vision and courage. When he pitched the idea of Antin, many saw infrastructure as niche or boring. But he believed in it. Today, Antin is a €33+ billion platform with global reach.

He recalled the difficult context of launching Antin just before the 2008 financial crisis. BNP Paribas supported the firm’s creation while retaining a 40% stake. As the crisis hit and pressure on returns mounted, Rauscher faced internal resistance to reinvesting in the business. “If we focused only on maximizing dividends, we would have killed the story,” he said. He knew that trust—especially during turbulent times—was essential for long-term success.

“Sometimes you must go against the grain and defend your vision,” he said, recalling how he risked being fired ,as it happened to some peers, for proposing the buyout of the bank’s stake in Antin. He persevered—and won.

“You need grit,” he added, “a legitimate purpose and the ability to explain why you're doing what you're doing—not to pick a fight, but because you believe in it.”

Bold choices are rarely easy, but they are often the ones that define a career—and a company.

6. Build and Invest in Skills Over Time to Differentiate

Success in finance comes from deepening your expertise over time and developing the judgment to know when (and how) to act. For Rauscher, differentiation has always been about substance, not speed.

He emphasized that becoming a good investor takes years, not months. Technical skills—like building financial models or analyzing deals—are essential, but not sufficient. “You don’t become an investor overnight,” he said. “It’s not about being the smartest in the room—it’s about developing judgment – what the Greeks call Phronesis.”

That’s why Antin prioritizes learning and exposure across disciplines. The firm regularly invites diverse speakers - from Nobel Prize-winning physicists to former intelligence leaders - to broaden employees’ perspectives. It’s all part of building a team capable of assessing complex situations with rigor and nuance.

Strategically, Antin’s decision to specialize in infrastructure, rather than become a generalist private equity player—was another way to stand apart. With dedicated focus on four sectors (energy, transportation, digital, and social infrastructure), the firm has become a European leader in a space that was once considered niche. “People wanted to put us in a box—energy bankers, French passport holders,” Rauscher said. “But we had to resist that and defend our vision.”

He also made clear that differentiation should not come at the expense of others. “Even in finance, performance must not be about crushing the competition,” he said. Instead, the goal should be to create sustainable value for investors, partners, and society.

In a word… Dare

Alain Rauscher closed his conversation with a powerful message to the next generation: “Go for it.” Whether you come from philosophy or engineering, whether your path is linear or full of twists, what matters most is having the courage to choose—and to build—a career aligned with your values.

His own journey is proof that success in finance doesn’t have to come at the expense of purpose, trust, or collaboration. Quite the opposite: when built on strong convictions, meaningful relationships, and a clear sense of long-term impact, a career in finance can become a powerful force for good.

Dare to explore. Dare to choose boldly. Dare to lead with values.

About the Private Equity & Infrastructure Certificate

The Private Equity & Infrastructure Certificate is a five-week advanced program offered at HEC Paris, designed to give students hands-on experience and deep insight into the workings of the private equity world. It combines academic rigor with direct exposure to leading practitioners, thanks to a longstanding partnership with Antin Infrastructure Partners. Throughout the program, students engage with top executives from Antin, who share real-world cases, career insights, and sector-specific expertise.

The certificate is led by Professor Oliver Gottschalg, Professor of Strategy at HEC Paris, a globally recognized specialist in buyouts and private equity. He is also the creator of the HEC Paris-DowJones Private Equity Performance Ranking, a respected benchmark for assessing the long-term performance of PE firms worldwide

👉 View the ranking

The 2025 edition concluded with a keynote conversation featuring Alain Rauscher, Founder and CEO of Antin, who shared lessons from his journey—from philosophy to private equity leader—offering students a rare blend of inspiration, ethics, and entrepreneurial insight